The Comprehensive Guide to Payments Orchestration

A key component of business growth and sustainability in the rapidly changing digital economy is the requirement for scalable, secure, and seamless payment infrastructure. Particularly for companies that deal with numerous payment providers, channels, and client preferences across borders, payments orchestration has become a potent solution.

By 2025, orchestrating payments is a strategic necessity rather than a luxury. This in-depth manual explains what payments orchestration is, why it is so important in today’s market, how it works, and the main advantages and factors to take into account for companies looking to optimize and secure their payment systems for the future.

Understanding Payments Orchestration

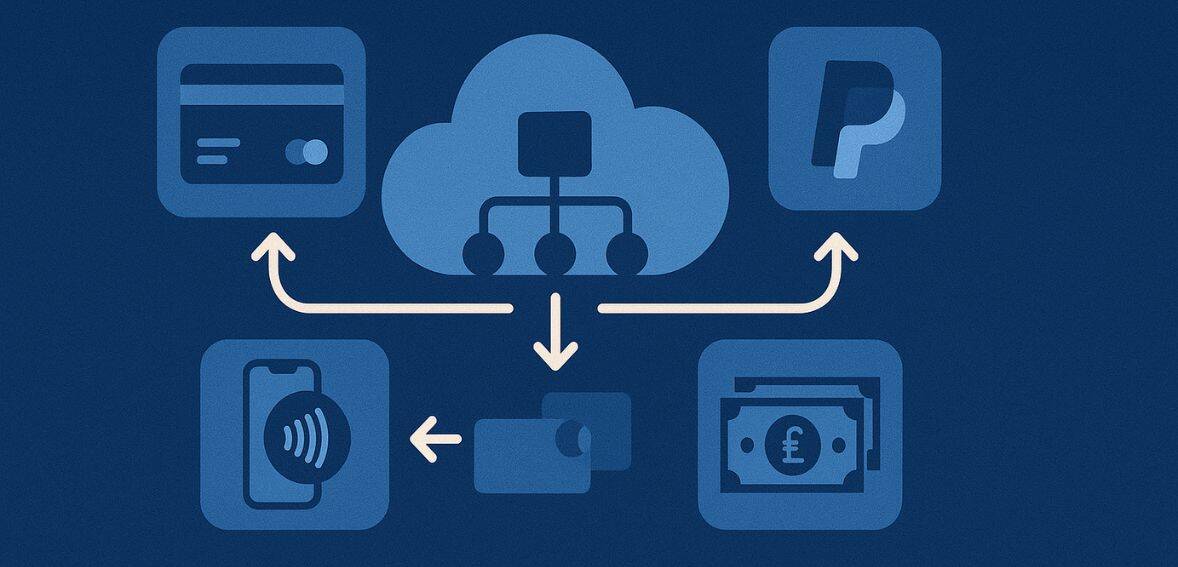

The use of a single, intelligent platform to coordinate, optimize, and manage payment processing across various providers, payment methods, fraud prevention systems, and geographical areas is known as payments orchestration. Merchants can handle every facet of payment flows from a single interface thanks to its abstraction of the difficulty of integrating multiple payment systems into a single, centralized layer.

Historically, companies had to integrate acquirers, risk tools, and individual payment service providers (PSPs) independently. This strategy restricted scalability, agility, and visibility in addition to adding operational complexity. This is addressed by payments orchestration platforms, which act as a central hub, handle all backend operations such as currency conversion, retries, and compliance checks, and route transactions via the most effective route while accommodating user preferences.

The Rising Need for Orchestration in 2025

As companies struggle with the intricacies of global digital transactions, changing alternative payment methods, and stricter regulatory environments, the need for payments orchestration has increased by 2025. Businesses are now expected to provide a wide range of international clients with smooth, omnichannel experiences. Conversion rates and profitability may suffer as a result of the difficulty of managing numerous payment service providers (PSPs), currencies, and compliance requirements.

Payments orchestration is a crucial remedy in this difficult setting. It enables enterprises to dynamically route transactions based on real-time performance metrics, intelligently decrease false declines while increasing authorization rates, and integrate multiple PSPs without requiring significant custom development. In addition to facilitating compliance with regional regulations such as GDPR, PSD2, and PCI DSS, orchestration platforms guarantee consistent user experiences across all touch points.

These systems also use retry logic and clever fallback mechanisms to effectively recover unsuccessful transactions. In summary, payments orchestration allows companies to quickly adapt while providing the best possible transaction outcomes by bridging the gap between operational complexity and customer-centric innovation.

Core Components of Payments Orchestration

A strong payments orchestration platform is made up of a number of interconnected parts that function together. These consist of:

- Payment Gateway Aggregation: It allows seamless connection to various local and global gateways, giving businesses the flexibility to choose or switch PSPs based on cost, performance, or geographic needs.

- Smart Transaction Routing: This makes it possible to make routing decisions in real time based on variables like issuer performance, network accessibility, customer location, or past approval rates.

- Fraud Management Integration: Plug-and-play fraud detection tools that can be tailored to business models are frequently included with or supported by orchestration platforms.

- Tokenization and Data Vaulting: Card information and sensitive data are tokenized and kept in PCI-compliant vaults for security and compliance, allowing for omnichannel use and safe recurring billing.

- Reconciliation and Reporting: Real-time dashboards offer insight into provider performance, chargebacks, settlement schedules, and transaction statuses.

- Failover and Retry Mechanisms: To increase approval rates and customer satisfaction, the platform automatically tries again via alternate routes or PSPs when a transaction fails.

- Compliance and Localization Tools: These tools assist companies in managing regional payment standards, KYC regulations, and tax laws.

In order to improve customer experiences, boost conversions, and lower friction, each of these components is essential.

Benefits of Payments Orchestration for Businesses

Payments orchestration offers a suite of advantages that make it a high-priority investment for digitally savvy businesses targeting a profitable niche

- Increased Payment Success Rates: Businesses can decrease unsuccessful transactions and increase revenue by allocating transactions to the best PSP based on historical data.

- Operational Efficiency: Businesses deal with a single orchestration platform, saving time and IT resources, rather than managing numerous integrations and service-level agreements.

- Scalability: Orchestration platforms facilitate expansion with little technical overhead, whether expanding into new markets or introducing new goods.

- Enhanced Security and Compliance: By centralizing the management of GDPR, PCI-DSS, and other standards, risk is decreased and audit preparedness is increased.

- Improved Customer Experience: Increased satisfaction and loyalty are a direct result of quicker checkout times, fewer declines, and more payment options.

- Data Transparency and Optimization: Centralized reporting and analytics enable businesses to make well-informed decisions.

- Vendor Independence: Businesses can add partners or change providers without having to re-engineer their systems because they are no longer restricted to using just one.

Payments Orchestration vs Payment Aggregators

However they both provide access to a variety of payment methods, payment orchestration and payment aggregators have distinct functions and degrees of control. By combining several merchants under a single master account, payment aggregators such as PayPal or Stripe streamline the acceptance of payments. Smaller companies that prefer a quick, plug-and-play solution without the trouble of creating separate merchant accounts will find this perfect.

Payment orchestration platforms, on the other hand, offer a far greater degree of control and personalization. In addition to using orchestration tools to access multiple PSPs, handle transactions across multiple channels, and intelligently route payments, merchants maintain their own acquiring relationships. Orchestration platforms, as opposed to aggregators, enable companies to minimize processing fees based on performance analytics, avoid vendor lock-in, and optimize routing in real-time.

Because of this, orchestration is better suited for medium-sized to large businesses, or any company looking to grow while keeping complete control over their payment stack. The differences between these models become more important in 2025 as companies become more data-driven and global in scope. Aggregators might be a good place to start, but many companies outgrow them and switch to orchestration platforms for increased productivity and competitive advantage.

Key Use Cases by Industry

Several industries benefit from payments orchestration:

- E-commerce: Enhance checkout experiences on all devices and maximize international transactions.

- Travel and hospitality: Effectively handle reservations, reimbursements, and foreign exchange.

- Subscription Services: Ideal for SaaS businesses to manage churn and facilitate seamless recurring billing.

- Digital media and gaming: Manage large, low-value transactions quickly and securely.

An orchestration layer that streamlines payments and improves dependability has distinct advantages for every industry.

Choosing the Right Payments Orchestration Provider

Since not all platforms have the same features, it’s critical to assess providers according to your unique requirements. Consider the following factors:

- Onboarding and Integration: How simple is it to link current systems? Does it support open SDKs and APIs?

- Coverage of Payment Methods and Geographies: Does the platform accommodate the currencies and regions that your clients use? Are widely used alternative payment methods accepted, such as BNPL or digital wallets?

- Flexibility and Customization: Are you able to modify the user flow, set up fraud tools, and create custom routing rules?

- Analytics and Insights: Seek out platforms that offer exportable reports, real-time analytics, and user-friendly dashboards.

- Support and Uptime: How much technical assistance is provided? Does a strong SLA with high uptime guarantees exist?

- Security and Compliance: Verify that the supplier complies with global privacy and data security standards.

Your orchestration layer will be able to adjust to changing business requirements if you select a platform that is adaptable and future-ready.

Future Trends in Payments Orchestration

The field of payments orchestration is always changing, and in 2025 and beyond, a number of trends will shape its future:

- AI and Machine Learning: AI will be used by more platforms for real-time decision-making, fraud detection, and intelligent routing.

- Decentralized Payments: Block chain and cryptocurrency wallet integration will expand.

- Embedded Finance: Within non-financial platforms, Orchestration will facilitate deeper financial services like payroll, insurance, and loans.

- Sustainable Payments: Eco-friendly reporting practices and green payment methods are quickly taking the lead in the industry.

- Multi-channel Commerce: Retail and hospitality will be dominated by unified payment orchestration for online, mobile, and in-store transactions.

Companies that adopt these innovations will put themselves in a position to be agile and competitive in the long run.

Role of Orchestration in Fraud Prevention and Compliance

Payments orchestration is essential for compliance and fraud prevention in addition to streamlining transaction routing and increasing approval rates. Payment orchestration platforms offer real-time insights into suspicious activity by combining several fraud detection layers, including machine learning risk engines, velocity checks, and device fingerprinting.

In addition to safeguarding the company, this multi-layered security makes the environment safer for clients. Risk rules can be dynamically modified by orchestration engines according to customer behavior, transaction size, or geography. For instance, it is possible to route a high-value transaction from an unknown IP address through an additional authentication layer prior to approval. In a similar vein, transactions that don’t fit the typical behavior profile of a customer may be rejected or flagged by the system.

By centralizing sensitive data handling and delivering audit-ready reports, orchestration assists merchants in complying with local laws such as GDPR in Europe or PCI DSS worldwide. By upholding security and transparency, this guarantees that companies not only stay out of trouble but also win over customers’ trust. Orchestration platforms offer a scalable and future-proof method of managing fraud and compliance risks without slowing down operations as regulatory environments continue to change in 2025.

Conclusion: Future-Proofing Your Payments Ecosystem

An outdated or disconnected payment infrastructure can impede development in a time of unrelenting innovation. One clever, scalable, and effective method to centralize, optimize, and future-proof your payment systems is through payments orchestration. Whether you’re a marketplace handling multi-party payouts, a business growing internationally, or a software as a service (SaaS) provider specializing in recurring billing, orchestration enables you to quickly satisfy client demands and business requirements.

Businesses can increase revenue, enhance customer experiences, and gain the flexibility they need to prosper in the quickly evolving digital economy by implementing payments orchestration. Choosing the best provider is not the key to the future of payments; rather, it is about planning the best path.